CBDCs, Digital ID, and Why Many Are Quietly Turning to Precious Metals

WHY THIS CONVERSATION MATTERS FOR PREPPERS

Preparedness has always been about understanding systems before they fail or change, not reacting after the fact. Food systems, energy systems, healthcare systems, and financial systems all share one thing in common: when they become centralized and fragile, individuals lose flexibility.

The global financial system is now undergoing a structural transition that most people are not paying attention to because it is happening gradually, through policy papers, pilot programs, and regulatory changes rather than dramatic announcements. Central Bank Digital Currencies, digital payment rails, and Digital Identity frameworks are being developed as long-term infrastructure — not emergency measures.

For preppers, the concern is not whether these systems will exist, but what happens when participation becomes mandatory, alternatives disappear, and legacy options like cash are reduced or marginalized. Preparedness asks uncomfortable but necessary questions early, when there is still time to adapt.

For preppers, the concern is not whether these systems will exist, but what happens when participation becomes mandatory, alternatives disappear, and legacy options like cash are reduced or marginalized. Preparedness asks uncomfortable but necessary questions early, when there is still time to adapt.

The rising interest in gold and silver reflects this mindset. It is less about fear of collapse and more about maintaining independence in an increasingly permission-based world.

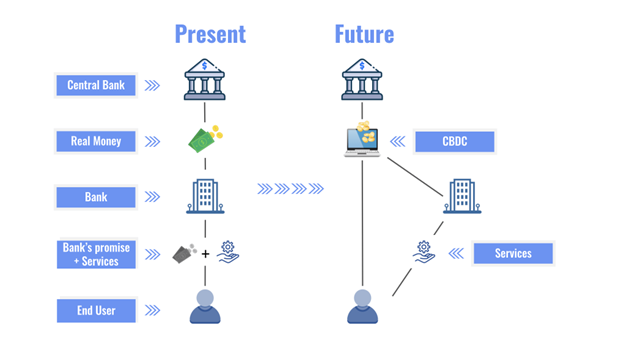

WHAT CBDCs ARE (IN PRACTICAL TERMS)

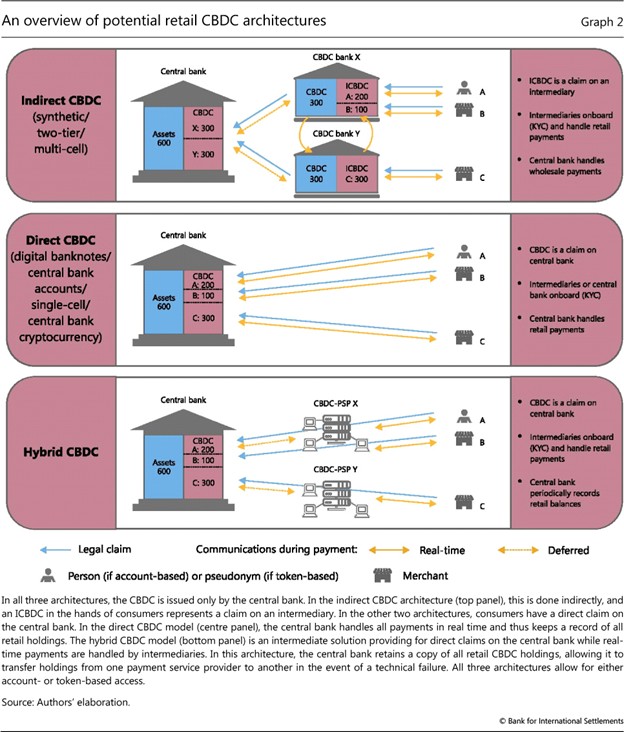

CBDCs are often described as “digital cash,” but that description is misleading. Cash is bearer money — if you hold it, you own it, and you can exchange it without asking permission. CBDCs are account-based or wallet-based systems issued and governed directly by central banks.

From a technical perspective, CBDCs allow:

- Real-time transaction monitoring

- Programmable spending conditions

- Policy-driven controls during emergencies

- Integration with tax, benefit, and regulatory systems

Supporters emphasize fraud reduction and efficiency. From a preparedness perspective, however, the issue is concentration of control. When the same authority that issues currency can also enforce spending rules, freeze accounts, or impose restrictions, financial independence becomes conditional.

This does not mean CBDCs are inherently malicious. It does mean they introduce new single points of failure — technological, political, and administrative — that did not exist with physical cash.

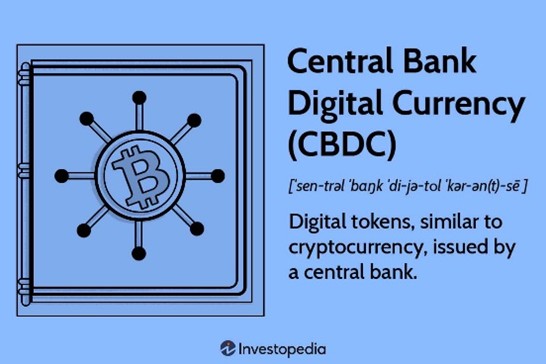

CBDCs are digital versions of national currencies, issued and managed directly by central banks.

From a preparedness perspective, the key differences are structural:

Feature Cash Bank Deposits CBDCs

Requires permission ❌ No ⚠️ Sometimes ✅ Yes

Can be programmed ❌ No ❌ No ✅ Yes

Can be restricted ❌ No ⚠️ Yes ✅ Yes

Requires identity ❌ No ✅ Yes ✅ Yes

Works offline ✅ Yes ❌ No ⚠️ Limited

Preparedness means recognizing that efficiency often comes at the cost of resilience.

DIGITAL ID: WHERE MONEY AND IDENTITY MEET

Digital Identity systems are often discussed separately from CBDCs, but in practice they are deeply interconnected. Digital ID provides the authentication layer that allows programmable money to function at scale.

In a fully integrated system, Digital ID may be required to:

- Access financial accounts

- Receive wages or benefits

- Pay taxes or utilities

- Travel or access services

This creates a world where financial participation is inseparable from identity verification and compliance status. The more integrated the system becomes, the harder it is to participate anonymously, privately, or independently.

For preppers, the concern is not surveillance alone — it is conditional access. If financial access can be altered based on policy, behavior, or administrative decisions, then money is no longer neutral. It becomes an enforcement tool.

Physical assets, including precious metals, exist entirely outside this framework. They do not rely on credentials, databases, or uptime.

WHY PRECIOUS METALS ARE PART OF PREPAREDNESS

Gold and silver are not modern inventions, but their relevance increases during periods of transition. Throughout history, whenever monetary systems changed — whether through debasement, digitization, or political restructuring — physical stores of value retained usefulness.

From a preparedness standpoint, precious metals offer:

- Durability: they do not degrade

- Universality: recognized across cultures

- Independence: no issuer or counterparty

- Continuity: value persists across systems

Central banks themselves acknowledge this reality, which is why many are increasing gold reserves even while promoting digital currencies. Institutions hedge against the very systems they are building.

For individuals, precious metals function as financial insurance — not a replacement for daily systems, but a fallback if those systems restrict access or fail temporarily.

THIS IS NOT ABOUT “THE END OF MONEY”

One of the biggest misunderstandings around precious metals accumulation is the assumption that buyers expect imminent collapse. In reality, most informed buyers expect continuity with increasing control, not sudden failure.

History shows that systems rarely collapse outright. Instead, they evolve in ways that:

- Reduce individual autonomy

- Increase administrative oversight

- Limit alternative options over time

Preparedness is not about rejecting modern systems. It is about recognizing that once legacy options are removed, rebuilding independence becomes difficult or impossible.

Gold and silver are not a protest — they are a hedge against narrowing choices.

GOLD VS SILVER: PRACTICAL ROLES

Gold and silver serve different roles and should not be treated interchangeably.

Gold excels at:

- Preserving large amounts of value

- Portability across borders or systems

- Long-term wealth continuity

Silver excels at:

- Smaller denominations

- Practical trade

- Recognizable everyday value

- Industrial utility support

For preparedness, silver often makes more sense for flexibility, while gold functions as long-term storage. Neither should dominate a preparedness plan — they should complement cash reserves, skills, tools, and community relationships.

No asset replaces competence.

CAN YOU AVOID DIGITAL SYSTEMS COMPLETELY?

Complete avoidance is unrealistic in modern society. Employment, utilities, taxes, and commerce are already deeply digital. Preparedness does not require disengagement — it requires reducing single-system dependency.

Practical resilience strategies include:

- Keeping some value outside digital systems

- Maintaining short-term cash liquidity

- Avoiding over-automation of finances

- Understanding how to function during outages or restrictions

Preparedness is about maintaining agency, not isolation.

LOCAL ECONOMIES AND COMMUNITY RESILIENCE

Centralized systems are efficient but brittle. Local systems are slower but resilient.

Barter, mutual aid, and skill exchange are not relics of the past — they are parallel systems that activate naturally when centralized systems strain or fail.

In these environments:

- Trust matters more than policy

- Skills matter more than credentials

- Tangible goods matter more than digital balances

Precious metals fit naturally into these systems because they are widely recognized and do not require technological mediation. However, they are most effective when embedded within real relationships and community networks.

CIVIC ACTION AND PERSONAL PREPAREDNESS

Civic engagement remains important. Advocating for:

- Cash protections

- Privacy safeguards

- Opt-out provisions

- Transparent policy development

can influence how systems are implemented.

However, preparedness planning assumes that individual readiness is still necessary regardless of political outcomes. Policies change, leadership shifts, and emergency powers expand during crises.

Preparedness bridges the gap between ideals and reality.

QUIET PREPAREDNESS IS THE GOAL

The most resilient people are rarely loud about their preparations. They quietly:

- Reduce fragile dependencies

- Build skills that cannot be digitized

- Maintain physical assets responsibly

- Strengthen local relationships

- Stay adaptable as systems evolve

Preparedness is not fear-based. It is choice-based.

As financial systems become more centralized and programmable, maintaining a small degree of independence is no longer extreme — it is prudent.

DISCLAIMER (FOR PREPPINGCOMMUNITIES.COM)

Disclaimer: The content on this page is provided for informational and educational purposes only. It does not constitute financial, legal, or investment advice. Technologies, policies, and financial systems discussed may change over time. Readers are encouraged to conduct independent research and consult qualified professionals before making financial decisions.

SOURCING & FURTHER READING (NON-SENSATIONAL)

Bank for International Settlements (BIS) – CBDC Research Papers

International Monetary Fund (IMF) – Digital Money Reports

World Economic Forum – Digital Identity Frameworks

U.S. Federal Reserve – CBDC Discussion Papers

European Central Bank – Digital Euro Project

World Gold Council – Central Bank Gold Demand Reports

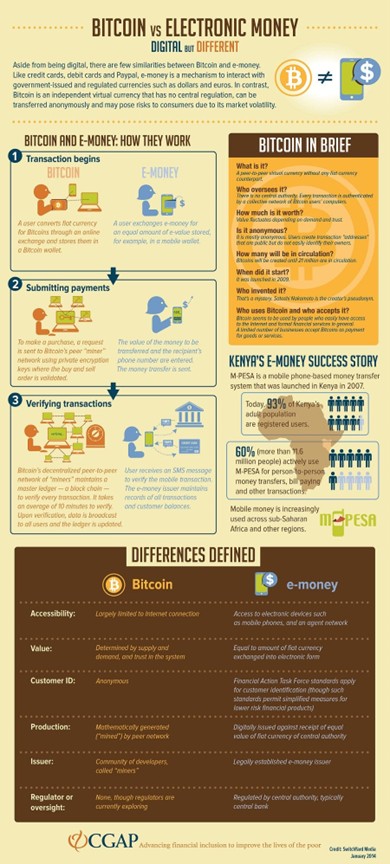

Digital Currencies vs Other Payment Methods

Bitcoin vs Electronic Money