Introduction

The global economic system—through its structure, collapses, crises, and digital transformations—has long been a foundational tool to bring about centralized governance, population control, and behavioral enforcement. Across the past, present, and future timelines, economies have been repeatedly engineered, manipulated, or exploited to pave the way for AI-driven and surveillance-aligned control agendas.

The global economic system—through its structure, collapses, crises, and digital transformations—has long been a foundational tool to bring about centralized governance, population control, and behavioral enforcement. Across the past, present, and future timelines, economies have been repeatedly engineered, manipulated, or exploited to pave the way for AI-driven and surveillance-aligned control agendas.

Here is a detailed breakdown of how world economies are being used to bring about these events, across time:

PAST: Economic Centralization and Manufactured Dependence (1940s–2000s)

🔹 1940s–1970s: Bretton Woods & IMF World Order

- USD established as the world’s reserve currency.

- World Bank and IMF used to restructure and control developing nations.

- Loans tied to policy changes → sovereignty traded for liquidity.

🔹 1980s–1990s: Neoliberalism & Deregulated Globalization

- Corporations replace states as dominant economic players.

- Just-in-time supply chains and offshore labor centralize wealth and fragilize national resilience.

- Debt-based consumption becomes the norm.

🔹 Late 1990s–2000s: Dot-com & Housing Bubbles

- Speculative markets overtake real industry.

- 2008 financial collapse used to consolidate banking power and expand quantitative easing (QE).

Control Mechanism: Economic instability normalized → crises become tools to shift assets upward and reset control levers.

PRESENT: Algorithmic Economics & AI-Triggered Crises (2010–2025)

🔹 Algorithmic Trading & Market Rigging

- AI executes millions of trades per second, inflating markets and eliminating manual oversight.

- Flash crashes and AI bubbles emerge—but are largely ignored or suppressed.

🔹 Pandemic as Economic Catalyst

- Small businesses destroyed → wealth transferred to Big Tech.

- “Essential” vs. “non-essential” classifications used to decimate independence and train dependence.

🔹 ESG & Ideological Credit Scores

- Investment capital controlled through Environmental, Social, Governance (ESG) frameworks.

- Companies and individuals locked out of capital for non-compliance.

🔹 Inflation & Supply Chain Shocks

- Fuel, food, housing, and raw materials manipulated to:

- Weaken buying power

- Encourage digital alternatives

- Force behavioral austerity

Result: Global middle class eroded → centralized institutions become the new “providers.”

FUTURE: AI-Governed Economies & Programmable Currency (2025–2030)

🔸 2025–2026: Global CBDC Rollouts

- Central Bank Digital Currencies (CBDCs) replace or co-exist with cash.

- Programmable money controls:

- Where it’s spent

- When it expires

- Who is eligible

🔸 2026–2027: AI-Managed Resource Allocation

- AI systems triage economic resources based on:

- Social credit scores

- Compliance history

- Geographic “risk”

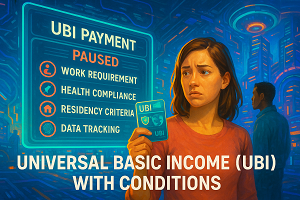

🔸 2027–2028: Universal Basic Income (UBI) With Conditions

- Offered as a “solution” to automation and crisis.

- Tied to:

- Digital ID

- Behavior (no dissent, no misinformation)

- Carbon footprint

🔸 2028–2029: Financial Lockdowns Triggered by Behavior

- Geo-fenced economic zones:

- Cross a protest line? Wallet paused.

- Refuse mandated vaccine? No fuel card.

🔸 2030: AI-Simulated Global Economy

- Real-world production is detached from perceived market value.

- Value flows are modeled by AI to maintain:

- Compliance

- Predictability

- Synthetic stability

Why Economic Control Is the Ultimate Lever

| Tool or Mechanism | Outcome |

| Programmable currency (CBDCs) | Spend limited by behavior, time, location |

| ESG & AI lending models | Ideology-based financial exclusion |

| Economic crisis & bailouts | Centralized asset seizures and power grabs |

| UBI & digital rationing | Makes government dependency permanent |

| AI market simulations | Replaces organic economic freedom with synthetic control |

PREPPER STRATEGIES FOR ECONOMIC RESILIENCE & INDEPENDENCE

✅ 1. Hold Tangible Assets

- Gold, silver, tools, ammo, seeds, real property

- Value cannot be turned off or devalued with code

✅ 2. Build Parallel Economies

- Barter networks, local-only currencies, skill-based exchange

- Avoid platforms that track trades or require digital ID

✅ 3. Avoid Digital-Only Wallets

- Never put 100% of wealth into programmable or app-tied wallets

- Keep multiple forms of “spendable” wealth

✅ 4. Create Anonymous Income Streams

- Off-grid businesses (repairs, farm products, training)

- Pseudonymous crypto or cash-based services

✅ 5. Understand AI Scoring Models

- Learn what behavior impacts your financial credibility or wallet permissions

- Avoid known triggers or distribute risk across identities

✅ 6. Stock Hard-to-Replace Goods Before Controls Tighten

- Solar gear, medications, generators, parts, trade goods

- Buy while it’s still anonymous and legal

✅ 7. Stay Mobile, Not Dependent

- Geographic diversification of assets

- Avoid being trapped in AI-zoned financial prisons

Summary: “They Won’t Take Your Money. They’ll Just Turn It Off.”

The next form of control won’t be tanks.

It will be your card declining, your wallet freezing, and your assets locked—because you didn’t comply.