Article By Ed McKinley

LuckBox

Are Blackstone and Wall Street Buying Up America’s Neighborhoods? The Answer Is YES.

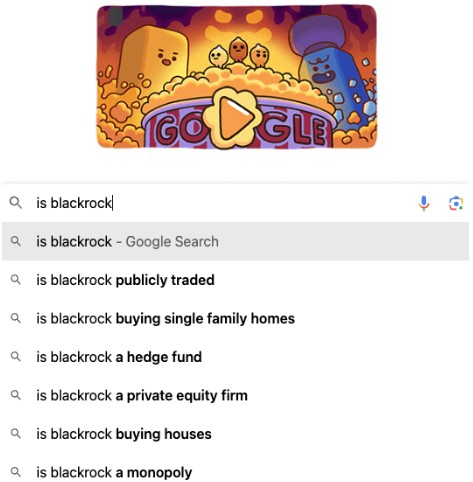

Americans are starting to ask a serious question:

Is Blackstone, the world’s largest alternative investment firm, buying up single-family homes and turning them into rentals?

Type “is Blackstone buying…” into Google, and you’ll see the top result:

“Is Blackstone buying homes?”

That’s no accident. It’s a growing concern — and it’s absolutely true.

In May, Blackstone became the third-largest institutional owner of single-family homes in the U.S. after purchasing Tricon Residential and its 37,478 properties for $3.5 billion.

That brings Blackstone’s total to 61,964 homes — not far behind the top two:

-

Progress Residential – 83,502 homes

-

Invitation Homes – 81,716 homes

Blackstone’s move marks a return to the top. They actually started Invitation Homes back in 2012 to scoop up foreclosed properties after the housing crash. By 2019, they cashed out with a $7 billion return — doubling their investment.

Then in 2021, they paid $6 billion for Home Partners of America, adding another 17,000 homes to their portfolio. And now, with the Tricon deal, Blackstone is back near the top of the corporate landlord game.

Why it matters:

This isn’t just business. It’s a slow takeover of the housing market by Wall Street. As corporations buy up homes, they:

-

Turn would-be homeowners into lifelong renters

-

Drive up prices for everyone

-

Consolidate control of land and housing in fewer hands

What can we do?

Support local builders. Advocate for housing access. And remember:

Freedom starts with owning land — not renting it back from billionaires.